A Journey to Financial Independence: Narayanan’s Path to a Rs. 3 Crore Investment Corpus

In the realm of personal finance, few stories are as inspiring and insightful as Narayanan’s journey to building a substantial investment corpus of Rs. 3 crore. This narrative is a testament to the power of disciplined saving, strategic investing, and a long-term vision.

Early Days and Savings Habits

Narayanan, a 39-year-old from Chennai, began his career in 2008 but was late to the investing game, starting with modest investments in mutual funds (MFs) around 2015. However, his savings habits were exemplary from the very beginning. He adhered to a strict savings regimen, aiming to save close to 90% of his income.

For the first seven years of his career, Narayanan’s investments were primarily in fixed deposits (FDs), Public Provident Fund (PPF), and Provident Fund (PF), with no exposure to equity. This conservative approach helped him accumulate a significant amount, which he later used to fund the renovation of his house in 2013, avoiding the need for a home loan.

To learn more about strategies for disciplined saving, check out Becoming a Crorepati with Rs 3000 Monthly SIP in Infosys and TCS Stocks.

Transition to Equity Investments

By the end of 2013, Narayanan had around Rs. 3 lakh in savings, which he rebuilt mainly through FDs until 2015. It was in 2015 that he started investing in mutual funds, marking a pivotal shift in his investment strategy. From 2018 onwards, he began investing in direct stocks, substantially increasing his equity portfolio over the next seven years.

For insights on mutual fund strategies, explore Top AIF Funds in 2024: Highest Returns for Investors.

Current Investment Portfolio

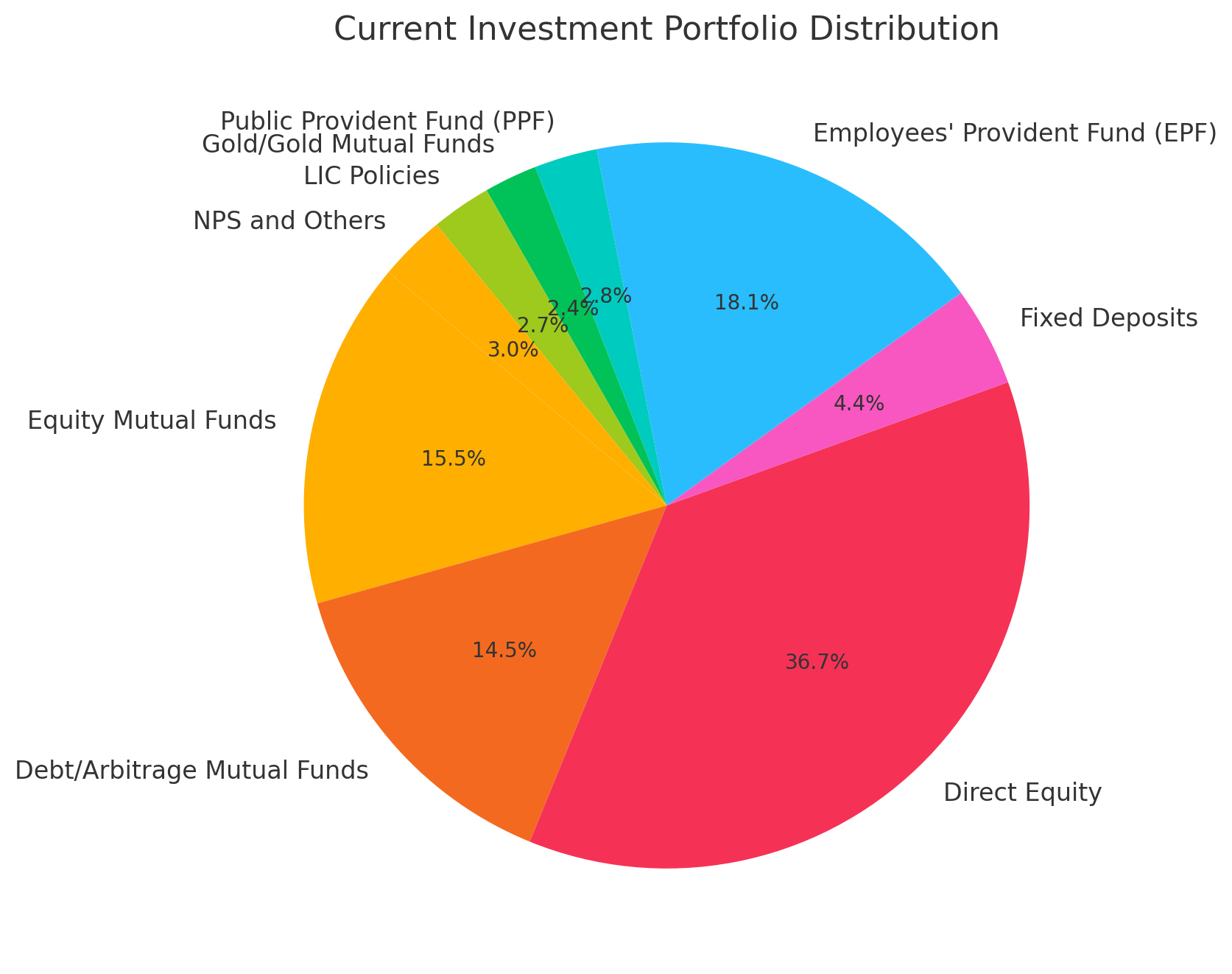

As of today, Narayanan’s combined corpus with his wife stands at Rs. 3.4 crore, distributed across various asset classes:

| Asset Class | Value (₹) |

|---|---|

| Equity Mutual Funds | 52.27 lakh |

| Debt/Arbitrage Mutual Funds | 49 lakh |

| Direct Equity | 1.24 crore |

| Fixed Deposits | 15 lakh |

| Employees’ Provident Fund (EPF) | 61.35 lakh |

| Public Provident Fund (PPF) | 9.5 lakh |

| Gold/Gold Mutual Funds | 8 lakh |

| Life Insurance Policies | 9 lakh |

| NPS and Others | ~10 lakh |

This diversified portfolio reflects a balanced approach to achieving financial independence.

Pie Chart Visualization

Below is a visualization of the above table, highlighting the percentage allocation of each asset class:

Insurance and Risk Management

Apart from his investment portfolio, Narayanan has also prioritized risk management through comprehensive insurance coverage. He has private medical insurance of Rs. 7.5 lakh with a top-up cover of Rs. 50 lakh and term life insurance of Rs. 1 crore for himself and Rs. 50 lakh for his wife. He plans to increase the term life insurance coverage in the near future.

Explore the importance of financial protection in HDFC Mutual Fund Reduces Stake in Rekha Jhunjhunwala’s Tata Hotels Stock.

Investment Strategy and Goals

Narayanan’s investment strategy is characterized by a balanced approach, with an equity-to-debt ratio of approximately 50:50. Having built a substantial direct stock portfolio, he has now shifted his focus to mutual funds, investing around Rs. 2-2.3 lakh per month.

| Year | Monthly SIP (₹) | Annual Return (%) | Corpus Achieved (₹) |

|---|---|---|---|

| 2023 | 2,00,000 | 9% | 2.5 crore |

| 2024 | 2,30,000 | 11% | 3 crore |

His long-term goal is to achieve financial independence within the next 5-7 years, aiming for a corpus of around Rs. 7-8 crore.

Key Takeaways and Insights

Narayanan’s journey offers several valuable lessons for aspiring investors:

- Disciplined Saving: Consistent and high savings rates are crucial for building a substantial corpus over time.

- Diversification: A balanced portfolio with a mix of equity, debt, and other asset classes helps in managing risk and optimizing returns.

- Long-Term Perspective: Investing is a long-term game; patience and persistence are key to achieving financial goals.

- Risk Management: Adequate insurance coverage is essential for protecting one’s financial health against unforeseen events.

Conclusion

Narayanan’s story is a compelling example of how systematic investing, coupled with a disciplined savings approach, can lead to significant financial milestones. His journey underscores the importance of starting early, being patient, and maintaining a well-diversified investment portfolio. For those aspiring to achieve financial independence, Narayanan’s experience serves as a motivational and informative guide, highlighting the steps and strategies that can help in reaching such ambitious financial goals.