The Union Budget 2025-26 has been announced, bringing major reforms across taxation, investments, MSMEs, and infrastructure. This year’s budget is focused on Viksit Bharat (Developed India), with key themes around Agriculture, MSMEs, Investments, and Exports.

Let’s dive into the most important takeaways and how they impact your finances and investment strategies.

🏛 Union Budget 2025-26 Summary

📢 Presented by Finance Minister Nirmala Sitharaman

📅 February 1, 2025

🔹 Theme: Viksit Bharat – A Developed India

🔹 Growth Focus: Agriculture, MSMEs, Investment, and Exports

🔹 Fiscal Deficit Target: 4.4% of GDP (vs. 4.8% last year)

📊 India’s Economic Roadmap

| 💰 Indicator | 📅 2025-26 Estimate |

|---|---|

| 📉 Fiscal Deficit | 4.4% of GDP |

| 💵 Total Revenue | ₹34.96 lakh crore |

| 🏗 Capital Expenditure | ₹10.18 lakh crore |

| 💰 Tax Revenue | ₹28.37 lakh crore |

📌 India remains the fastest-growing major economy! 🚀

Pro Tip: A lower fiscal deficit means economic stability, lower inflation risk, and a stronger rupee. This is positive for long-term investors and debt market participants. Check out how capital gains tax changes might affect you

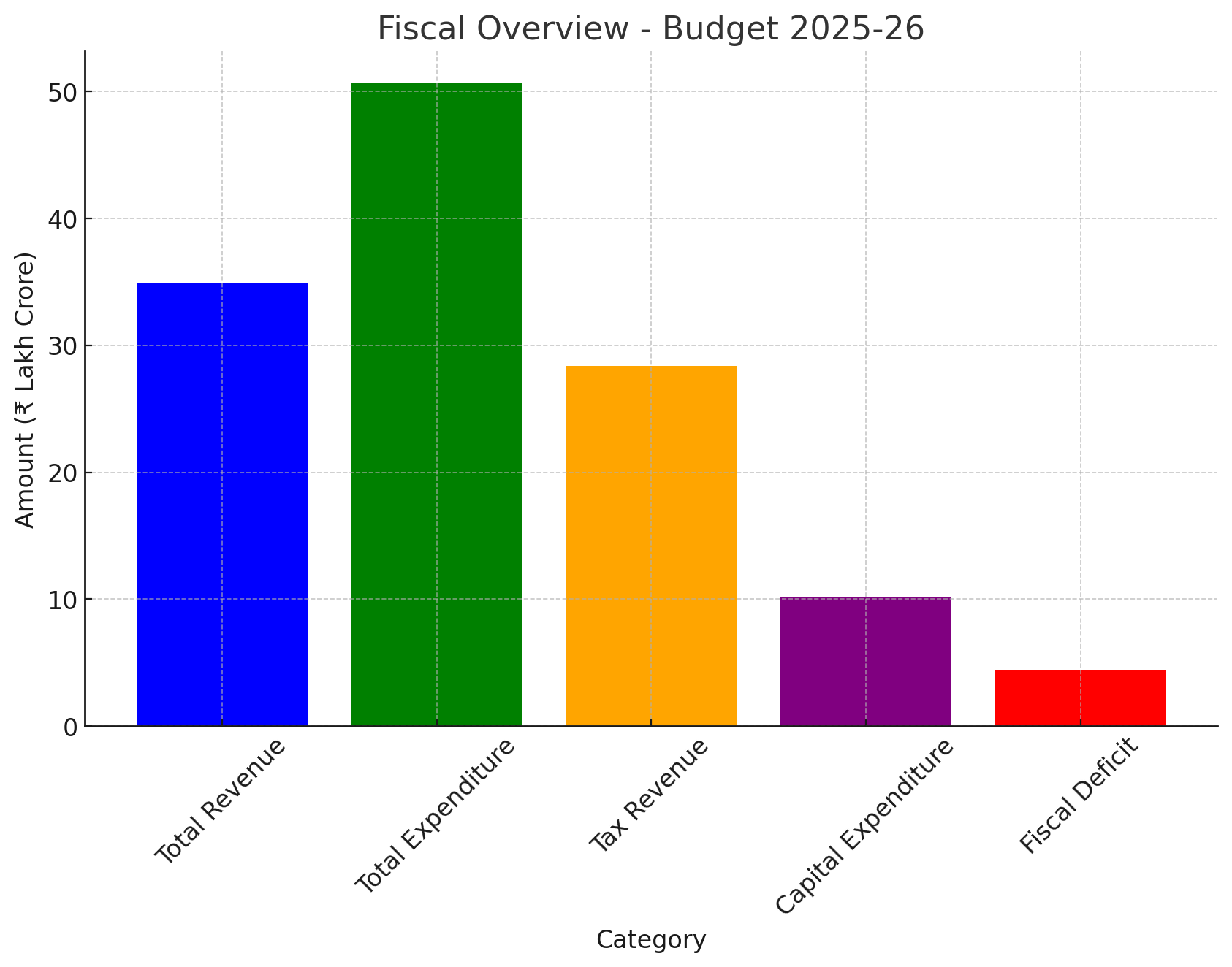

📊 Fiscal Overview

The Indian economy continues its rapid growth, and the budget outlines significant fiscal measures:

- Total Revenue: ₹34.96 lakh crore

- Total Expenditure: ₹50.65 lakh crore

- Tax Revenue: ₹28.37 lakh crore

- Capital Expenditure: ₹10.18 lakh crore

- Fiscal Deficit: 4.4% of GDP (down from 4.8%)

🔎 What This Means for You

- Lower fiscal deficit = stable economy, lower inflation risk.

- Higher capital expenditure = more job opportunities & infrastructure growth.

- Increased tax revenue = better public services & economic growth.

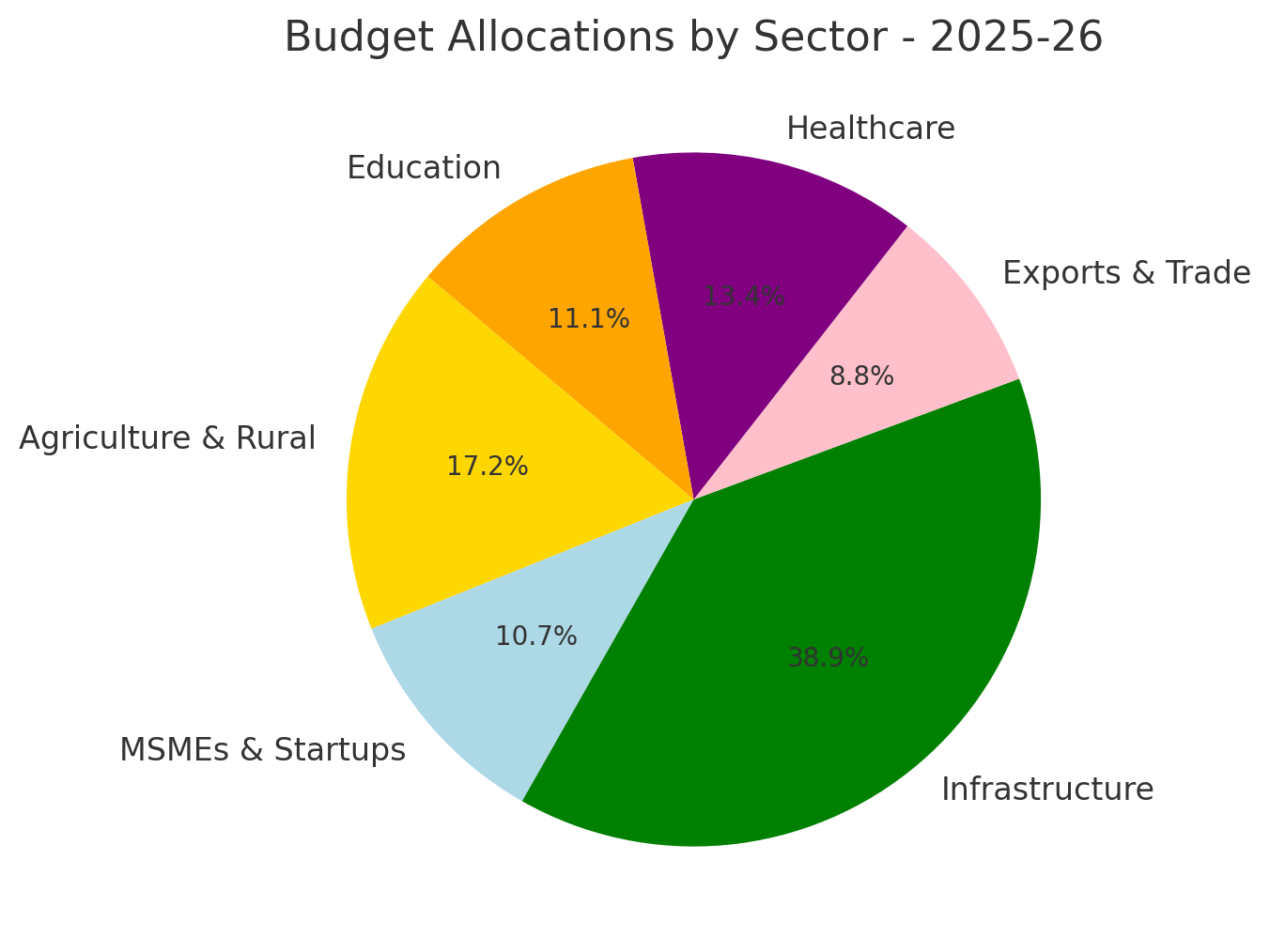

🏗 Budget Allocations by Sector

🖼 Sector-wise Allocation Chart:

📌 Key Beneficiaries:

- Infrastructure → Highways, railways, airports expansion

- Agriculture & Rural Development → Farmer support schemes

- Renewable Energy → Solar, wind, hydrogen investments

- Defense & Manufacturing → Indigenous defense production

🌾 Agriculture & Rural Economy

✅ PM Dhan-Dhaanya Krishi Yojana 🚜

- 100 low-yield districts to receive irrigation, warehousing & credit support.

- 1.7 crore farmers to benefit.

✅ Aatmanirbharta in Pulses 🌾

- Focus on Tur, Urad & Masoor → India aims for self-sufficiency.

✅ Enhanced Kisan Credit Card (KCC) Limits

- Loan limit raised from ₹3 lakh → ₹5 lakh.

✅ Fisheries & Marine Boost

- Lakshadweep & Andaman to become seafood hubs.

📌 Who benefits? → Farmers, rural youth, FPOs, agri startups

🏭 MSME & Startup Growth Engine

✅ Higher MSME Credit Access

- Credit guarantee doubled from ₹5 crore → ₹10 crore.

- Startups get a new ₹10,000 crore Fund of Funds.

✅ Revised MSME Classification

- MSMEs can now scale up without losing benefits.

✅ Support for Women & SC/ST Entrepreneurs

- 5 lakh entrepreneurs to receive ₹2 crore loans.

📌 Who benefits? → Small businesses, exporters, startups

📦 Boosting Exports & Trade

✅ BharatTradeNet (BTN) 🌐

- A unified digital trade platform for faster export approvals.

✅ Duty-Free Inputs for Handicrafts & Leather 👞

- Higher competitiveness for Indian exporters!

📌 Who benefits? → Exporters, MSMEs, leather & textile industries

🏗️ Infrastructure & Investment Boom

- ✅ 50-Year Interest-Free Loans to States

- ₹1.5 lakh crore allocated for infrastructure projects.

- ✅ Asset Monetization Plan 2025-30

- Govt to unlock ₹10 lakh crore from existing assets.

- ✅ Green Energy Investments

- ₹20,000 crore for Small Modular Reactors (SMRs).

📌 Who benefits? → Infra companies, energy sector, logistics

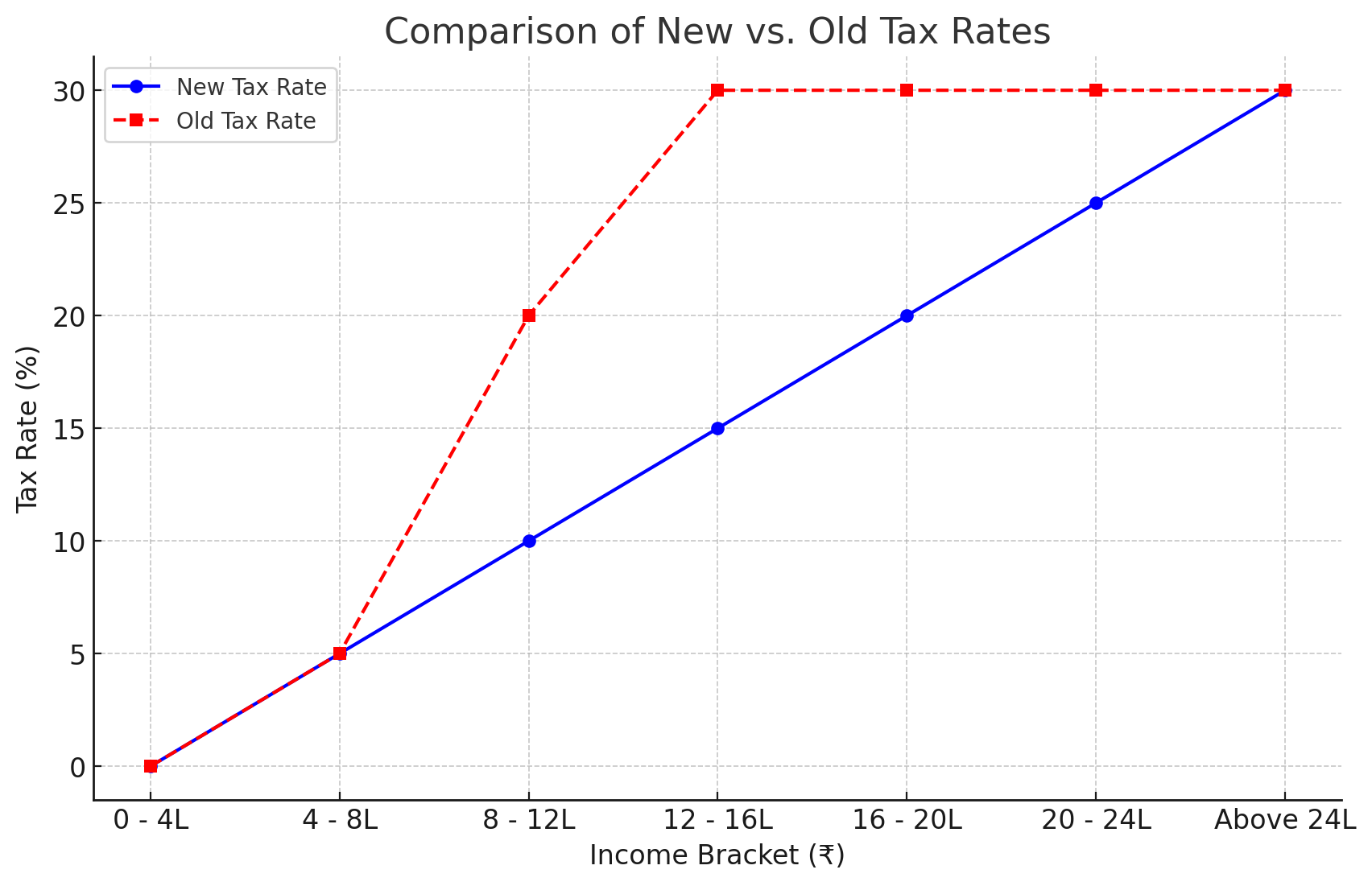

💰 Taxation: Major Relief for Middle-Class Taxpayers!

New Tax Slabs for 2025-26

| Income Bracket (₹) | New Tax Rate (%) | Old Tax Rate (%) |

|---|---|---|

| 0 – 4 lakh | Nil | Nil |

| 4 – 8 lakh | 5% | 5% |

| 8 – 12 lakh | 10% | 20% |

| 12 – 16 lakh | 15% | 30% |

| 16 – 20 lakh | 20% | 30% |

| 20 – 24 lakh | 25% | 30% |

| Above 24 lakh | 30% | 30% |

🔎 How This Affects You

✅ Zero tax on income up to ₹12.75 lakh (after standard deduction).

✅ More disposable income → Higher savings & investment opportunities.

✅ Higher senior citizen tax-free interest limit (₹1 lakh vs ₹50,000 earlier).

🔴 Who Might Be Negatively Affected?

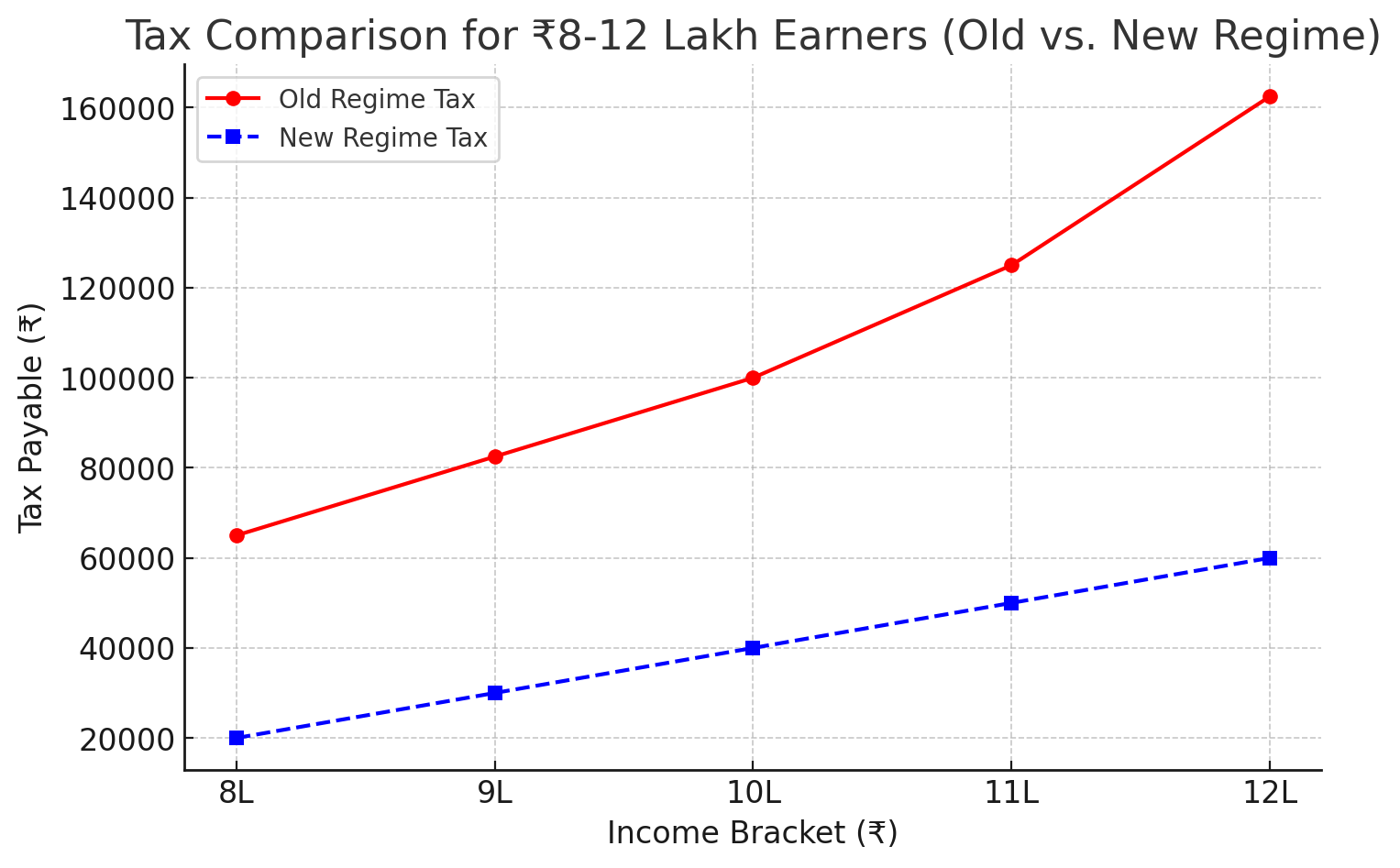

🚨 Negative Impact on Individuals Earning ₹8-12 Lakh

While the new tax regime lowers rates, individuals earning ₹8 lakh – ₹12 lakh who previously utilized deductions under HRA, 80C (PF, PPF, ELSS), 80D (medical insurance), and home loan interest may pay higher taxes if they lose these deductions.

Example Scenarios: Higher Tax Outflow Without Deductions

| Annual Income (₹) | Old Regime Tax (₹) With Deductions | New Regime Tax (₹) No Deductions | Increase/Decrease (₹) |

|---|---|---|---|

| 8 lakh | ₹35,000 | ₹20,000 | -₹15,000 |

| 9 lakh | ₹55,000 | ₹30,000 | -₹25,000 |

| 10 lakh | ₹75,000 | ₹40,000 | -₹35,000 |

| 11 lakh | ₹1,05,000 | ₹50,000 | -₹55,000 |

| 12 lakh | ₹1,35,000 | ₹60,000 | -₹75,000 |

📌 Key Takeaways

- Those not claiming deductions will benefit from the new tax slabs.

- Salaried employees with home loans, insurance, or investments may pay more in taxes if they lose deductions in the new regime.

- High-income professionals above ₹24 lakh may not see significant tax relief, as the top tax slab remains unchanged at 30% without additional deductions.

- Freelancers & consultants who previously benefited from business expense deductions under the old regime may have higher taxable income if they shift to the new regime.

- ✅ Zero tax on income up to ₹12.75 lakh (after standard deduction).

- ✅ Higher senior citizen tax-free interest limit (₹1 lakh vs ₹50,000 earlier).

Example Scenarios: Tax Outflow Comparison

| Annual Income (₹) | Tax Payable (Old Regime) | Tax Payable (New Regime) | Tax Savings (₹) |

|---|---|---|---|

| 8 lakh | ₹65,000 | ₹20,000 | ₹45,000 |

| 10 lakh | ₹1,00,000 | ₹40,000 | ₹60,000 |

| 12 lakh | ₹1,62,500 | ₹60,000 | ₹1,02,500 |

| 16 lakh | ₹2,40,000 | ₹1,20,000 | ₹1,20,000 |

| 20 lakh | ₹3,50,000 | ₹2,00,000 | ₹1,50,000 |

| 24 lakh | ₹4,50,000 | ₹3,00,000 | ₹1,50,000 |

🔎 What This Means for Salaried Professionals

✅ A person earning ₹10 lakh will now pay only ₹40,000, saving ₹60,000 in taxes!

✅ A ₹16 lakh salary holder will now save ₹1.2 lakh compared to last year.

✅ High earners at ₹24 lakh will save ₹1.5 lakh in taxes, increasing disposable income.

Conclusion: The new tax regime offers significant savings for individuals without deductions, but those who previously claimed tax benefits under HRA, Section 80C, and 80D should carefully evaluate whether to switch regimes or stick with the old system.

📢 Let us know your thoughts! Will you switch to the new tax regime or continue with the old one? Comment below! 👇

📈 Sectors Likely to Perform Well Post Budget 2025-26 & Stocks to Watch 🚀

🏗 Infrastructure & Construction

- ₹10.18 lakh crore capital expenditure → Boost for infra projects.

- High-speed rail, urban development, and airport expansions planned.

📌 Stocks to Watch:

- L&T, UltraTech Cement, IRB Infra, GMR Infra, Adani Ports

- Explore top mutual funds investing in infrastructure

🔋 Renewable Energy & EV Sector

- ₹20,000 crore investment in Small Modular Reactors (SMRs) for nuclear energy.

- Zero-duty on Lithium-ion battery components → EV sector boost.

📌 Stocks to Watch:

- Tata Power, Adani Green Energy, JSW Energy, Exide, Amara Raja Batteries

- Find out which mutual funds are investing in renewable energy

🏦 Financials & Banking

- More government borrowing → Higher demand for bonds & banking services.

📌 Stocks to Watch:

- HDFC Bank, SBI, Bajaj Finance, Kotak Mahindra Bank

📢 FAQs: Common Questions About Budget 2025-26

-

How does this budget impact small investors?

✅ Lower tax slabs = More disposable income = Higher investments in SIPs, stocks, and mutual funds. -

Will home loan interest rates be affected?

✅ Lower fiscal deficit reduces borrowing costs, making home loans cheaper in the long run. -

Does this budget impact mutual fund taxation?

✅ No direct increase in capital gains tax on mutual funds. -

Are there any benefits for startup entrepreneurs?

✅ ₹10,000 crore Fund of Funds for startups.

✅ Extended tax exemptions till 2030 for new startups.

🔥 Final Thoughts – Should You Be Excited?

✅ Best budget for middle-class taxpayers in recent years.

✅ Boost to MSMEs & startups → More job creation.

✅ Higher infra spending → Growth in real estate & related sectors.

✅ Stronger economic fundamentals → Attractive investment opportunities.